Get Contract

We refer to what is being traded in an order as a "contract". The specs of a specific contract are set by a exchange, and are used to identify a specific asset in global markets, across the exchanges. This information, and the information required to trade a certain contract, are embedded in the Contract object.

A typical contract object includes the following elements:

- Symbol: The ticker symbol of the stock/equity. The symbol of most U.S stocks only contains letters, HK stocks and Chinese A-Shares uses numbers as symbols of stocks. For example, the symbol of Tiger Brokers (NASDAQ) is TIGR

- Security type: Common Security types includes STK(Stocks), OPT(Options), FUT(Futures) and CASH(Forex). For example, the Security type of Tiger Brokers (NASDAQ) is TIGR

- Exchange: The code of the exchange in which the requested asset is traded. Contracts with Security typ of STK does not require this data field, as the orders will be routed automatically to a designated exchange, However, for futures, this field is necessary

Most stocks, CFDs, indexes or Forexs can be identify by those four elements. However, some contracts like Futures and Options has more attributes in their corresponding contract objects

Here are a few common types of contracts and what elements they consist of.

Stock

Contract ContractUtil::stock_contract(const utility::string_t symbol, const utility::string_t currency,

const utility::string_t local_symbol, const utility::string_t exchange,

long contract_id) {

return Contract(U("STK"), symbol, currency, local_symbol, exchange, contract_id);

}

Option

Tiger Securities API supports 2 options contract formats:

- One is the four-factor approach (symbol, expiry, strike, right).

Contract ContractUtil::option_contract(

const utility::string_t symbol,

const utility::string_t expiry,

const utility::string_t strike,

const utility::string_t right,

const utility::string_t currency,

long multiplier,

const utility::string_t local_symbol,

long contract_id)

{

return Contract(

U("OPT"), symbol, expiry, strike, right,

currency, multiplier, local_symbol, contract_id

);

}

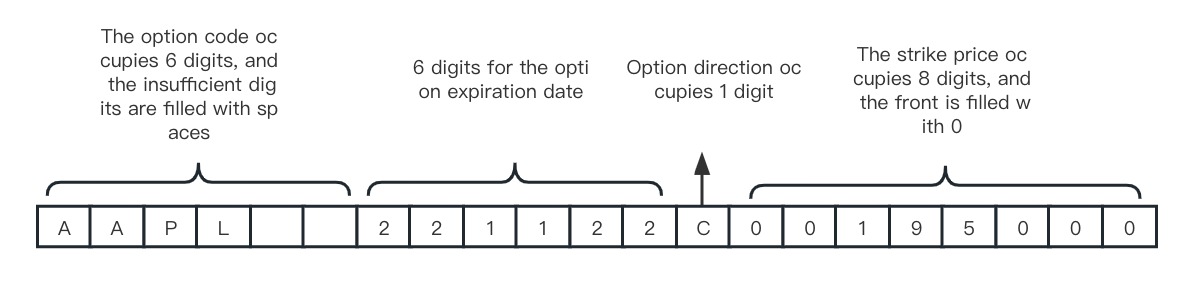

The other is the standard OCC option contract format, fixed length of 21 bits containing four parts:

- The code of the relevant stock or ETP, e.g. (AAPL), is fixed at six characters, with the missing digits filled by spaces

- Option expiration date, 6 digits, format: yymmdd

- Option type,including P or C, for put or call

- Option exercise price, the value of the price x 1000, fixed 8 digits, the first few digits are filled by 0

Contract ContractUtil::option_contract(

const utility::string_t identifier,

long multiplier,

const utility::string_t currency)

{

utility::string_t symbol, expiry, right, strike;

std::tie(symbol, expiry, right, strike) = ContractUtil::extract_option_info(identifier);

if (!expiry.empty() && expiry.find('-') != utility::string_t::npos) {

expiry.erase(std::remove(expiry.begin(), expiry.end(), '-'), expiry.end());

}

return Contract(U("OPT"), symbol, expiry, strike, right, currency, multiplier, U(""), 0);

}

get_contract Get a Contract

value get_contract(utility::string_t symbol, utility::string_t sec_type, utility::string_t currency = U(""), utility::string_t exchange = U(""), time_t expiry = -1, utility::string_t strike = U(""), utility::string_t right = U("")); value get_contract(utility::string_t symbol, SecType sec_type = SecType::STK, Currency currency = Currency::ALL, utility::string_t exchange = U(""), time_t expiry = -1, utility::string_t strike = U(""), Right right = Right::ALL);

Description

Get the contract Object

Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| symbol | utility::string_t | Yes | Ticker symbol of the stock/equity, example: 'AAPL' |

| sec_type | SecType | No | Security type default: SecType::STK |

| currency | Currency | No | Currencies of contract default: Currency::ALL |

| exchange | utility::string_t | No | Exchange code. Example: 'CBOE' |

| expiry | time_t | No | Options expiration date default: -1 |

| strike | utility::string_t | No | Options strike price |

| right | Right | No | 'PUT' / 'CALL' for options default: Right::ALL |

Response

Contract Object, Please see Objects for more information. Some attributes of this object are as follows

| Field | Type | Description |

|---|---|---|

| close_only | bool | Whether an asset or position can only be closed (sold or exited) and not opened (bought or entered) |

| currency | utility::string_t | Currency type,USD/HKD/CNH |

| identifier | utility::string_t | Unique Identifier: For stocks, the identifier is the same as the symbol. For options, it is a 21-character identifier, such as 'AAPL 220729C00150000'. For futures, it is the futures identifier |

| is_etf | bool | Whether it is an ETF |

| local_symbol | utility::string_t | Identify Warrants and Callable Bull/Bear Contracts for Hong Kong Stocks (Global accounts only) |

| long_initial_margin | float | Initial margin for long positions |

| long_maintenance_margin | float | Maintenance margin for long positions |

| marginable | bool | Eligible for margin trading |

| market | utility::string_t | Market |

| multiplier | float | Contracts per lot |

| name | utility::string_t | Contract name |

| sec_type | utility::string_t | STK - Stock / OPT - Option / FUT - Futures / WAR - Warrant / IOPT - Callable Bull/Bear Contracts (CBBC) |

| short_fee_rate | float | Short selling fee rate |

| short_initial_margin | float | Initial margin ratio for short selling |

| short_maintenance_margin | float | Maintenance Margin Ratio for Short Selling (No value for Global account contracts) |

| short_margin | float | Short Selling Margin Ratio (Deprecated, use short_initial_margin) |

| shortable | bool | Whether short selling is allowed |

| shortable_count | int | Remaining amount in short-selling pool |

| status | utility::string_t | Contract status |

| symbol | utility::string_t | Stock Code: For option contracts, the symbol corresponds to the underlying asset code |

| tickSizes | list<tickSize> | Stock only, Minimum quoting unit price range, i.e., when the order price is within the begin and end range, it must meet the tickSize requirement begin: left range of price, end: right range of price, type: TickSizeType, tickSize: minimum price unit |

| tradable | bool | Whether asset is tradable |

| trading_class | utility::string_t | Contract Trading level name |

Example

#include "tigerapi/trade_client.h"

#include "tigerapi/contract_util.h"

#include "tigerapi/order_util.h"

using namespace std;

using namespace web;

using namespace web::json;

using namespace TIGER_API;

class TestTradeClient {

public:

static void test_get_contract(const std::shared_ptr<TradeClient>& trade_client) {

value res = trade_client->get_contract("AAPL");

cout << "contract: " << res << endl;

}

static void test_trade(const std::shared_ptr<TradeClient>& trade_client) {

TestTradeClient::test_get_contract(trade_client);

}

};

int main(int argc, char *args[]) {

cout << "Tiger Api main" << endl;

/************************** set config **********************/

ClientConfig config = ClientConfig(true);

config.private_key = "-----BEGIN RSA PRIVATE KEY-----\n"

"xxxxxx private kye xxxxxxxx"

"-----END RSA PRIVATE KEY-----";

config.tiger_id = "Tiger ID";

config.account = "Account ID";

/**

* Use TradeClient

*/

std::shared_ptr<TradeClient> trade_client = std::make_shared<TradeClient>(config);

TestTradeClient::test_trade(trade_client);

return 0;

}

Response

{

"closeOnly": false,

"currency": "USD",

"identifier": "AAPL",

"isEtf": false,

"localSymbol": "AAPL",

"longInitialMargin": 0.29999999999999999,

"longMaintenanceMargin": 0.40000000000000002,

"marginable": true,

"market": "US",

"multiplier": 1,

"name": "Apple Inc",

"secType": "STK",

"shortFeeRate": 3.25,

"shortInitialMargin": 0.40000000000000002,

"shortMaintenanceMargin": 0.40000000000000002,

"shortMargin": 0.40000000000000002,

"shortable": 0,

"shortableCount": 0,

"status": 1,

"symbol": "AAPL",

"tickSizes": [

{

"begin": "0",

"end": "1",

"tickSize": 0.0001,

"type": "CLOSED"

},

{

"begin": "1",

"end": "Infinity",

"tickSize": 0.01,

"type": "OPEN"

}

],

"tradeable": true,

"tradingClass": "AAPL"

}

get_contracts Get Multiple Contracts

value get_contracts(const value &symbols, utility::string_t sec_type, utility::string_t currency = U(""), utility::string_t exchange = U(""), time_t expiry = -1, utility::string_t strike = U(""), utility::string_t right = U(""));

Description

Get multiple contract objects. The objects are returned as a list

Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| symbols | utility::string_t | Yes | Ticker symbol of the stock/equity, example: 'AAPL'. Maximum 50 per request |

| sec_type | SecType | Yes | Security type, example: SecType::STK |

| currency | Currency | No | Currencies, example: Currency::USD |

| exchange | utility::string_t | No | Exchange code, example: 'CBOE' |

| expiry | time_t | No | Contract expiration date |

| strike | utility::string_t | No | Strike price |

| right | utility::string_t | No | 'PUT' / 'CALL' / 'ALL' |

| Response |

list

Each element of this list is a contract object (/include/tigerapi/model.h). Refer to Contract Object for details

| Field | Type | Description |

|---|---|---|

| close_only | bool | Whether an asset or position can only be closed (sold or exited) and not opened (bought or entered) |

| currency | utility::string_t | Currency type,USD/HKD/CNH |

| identifier | utility::string_t | Unique Identifier: For stocks, the identifier is the same as the symbol. For options, it is a 21-character identifier, such as 'AAPL 220729C00150000'. For futures, it is the futures identifier |

| is_etf | bool | Whether it is an ETF |

| local_symbol | utility::string_t | Identify Warrants and Callable Bull/Bear Contracts for Hong Kong Stocks (Global accounts only) |

| long_initial_margin | float | Initial margin for long positions |

| long_maintenance_margin | float | Maintenance margin for long positions |

| marginable | bool | Eligible for margin trading |

| market | utility::string_t | Market |

| multiplier | float | Contracts per lot |

| name | utility::string_t | Contract name |

| sec_type | utility::string_t | STK - Stock / OPT - Option / FUT - Futures / WAR - Warrant / IOPT - Callable Bull/Bear Contracts (CBBC) |

| short_fee_rate | float | Short selling fee rate |

| short_initial_margin | float | Initial margin ratio for short selling |

| short_maintenance_margin | float | Maintenance Margin Ratio for Short Selling (No value for Global account contracts) |

| short_margin | float | Short Selling Margin Ratio (Deprecated, use short_initial_margin) |

| shortable | bool | Whether short selling is allowed |

| shortable_count | int | Remaining amount in short-selling pool |

| status | utility::string_t | Contract status |

| symbol | utility::string_t | Stock Code: For option contracts, the symbol corresponds to the underlying asset code |

| tickSizes | list<tickSize> | Stock only, Minimum quoting unit price range, i.e., when the order price is within the begin and end range, it must meet the tickSize requirement begin: left range of price, end: right range of price, type: TickSizeType, tickSize: minimum price unit |

| tradable | bool | Whether asset is tradable |

| trading_class | utility::string_t | Contract Trading level name |

Example

#include "tigerapi/trade_client.h"

#include "tigerapi/contract_util.h"

#include "tigerapi/order_util.h"

using namespace std;

using namespace web;

using namespace web::json;

using namespace TIGER_API;

class TestTradeClient {

public:

static void test_get_contracts(const std::shared_ptr<TradeClient>& trade_client) {

value symbols = value::array();

symbols[0] = value::string(U("AAPL"));

symbols[1] = value::string(U("JD"));

value res = trade_client->get_contracts(symbols, U("STK"));

ucout << U("contracts: ") << res << endl;

}

static void test_trade(const std::shared_ptr<TradeClient>& trade_client) {

TestTradeClient::test_get_contracts(trade_client);

}

};

int main(int argc, char *args[]) {

cout << "Tiger Api main" << endl;

/************************** set config **********************/

ClientConfig config = ClientConfig(true);

config.private_key = "-----BEGIN RSA PRIVATE KEY-----\n"

"xxxxxx private kye xxxxxxxx"

"-----END RSA PRIVATE KEY-----";

config.tiger_id = "Tiger ID";

config.account = "Account ID";

/**

* Use TradeClient

*/

std::shared_ptr<TradeClient> trade_client = std::make_shared<TradeClient>(config);

TestTradeClient::test_trade(trade_client);

return 0;

}

Response

[

{

"closeOnly":false,

"contractId":1916,

"currency":"USD",

"identifier":"AAPL",

"isEtf":false,

"localSymbol":"AAPL",

"lotSize":1,

"market":"US",

"multiplier":1,

"name":"Apple",

"secType":"STK",

"status":1,

"supportOvernightTrading":true,

"symbol":"AAPL",

"tickSizes":

[

{

"begin":"0",

"end":"1",

"tickSize":0.0001,

"type":"CLOSED"

},

{

"begin":"1",

"end":"Infinity",

"tickSize":0.01,

"type":"OPEN"

}

],

"tradeable":true,

"tradingClass":"AAPL"

},

{

"closeOnly":false,

"contractId":1722,

"currency":"USD",

"identifier":"JD",

"isEtf":false,

"localSymbol":"JD",

"lotSize":1,

"market":"US",

"multiplier":1,

"name":"JD.com",

"secType":"STK",

"status":1,

"supportOvernightTrading":true,

"symbol":"JD",

"tickSizes":

[

{

"begin":"0",

"end":"1",

"tickSize":0.0001,

"type":"CLOSED"

},

{

"begin":"1",

"end":"Infinity",

"tickSize":0.01,

"type":"OPEN"

}

],

"tradeable":true,

"tradingClass":"JD"

}

]

Construct Contract Object Locally

Stocks:

Contract contract = ContractUtil::stock_contract(U("AAPL"), U("USD"));

Options

Contract contract = ContractUtil::option_contract(U("AAPL"), U("20230721"), U("185.0"), U("PUT"), U("USD"));

Contract contract = ContractUtil::option_contract(U("AAPL 230721C00185000"));

Futures

Contract contract = ContractUtil::future_contract(U("NG2308"), U("USD"));

get_quote_contract

value get_quote_contract(utility::string_t symbol, utility::string_t sec_type, utility::string_t expiry)

Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| symbol | utility::string_t | Yes | security code |

| sec_type | SecType | Yes | security type support: (OPT/WAR/IOPT) |

| expiry | utility::string_t | Yes | expiry date str, format:yyyyMMdd, e.g. '20220929' |

Responselist

Each item in the list is a contract object( refer to tigeropen.trade.domain.contract.Contract) Contract object.

| Parameter | Type | Description |

|---|---|---|

| symbol | string | security code |

| name | string | contract name |

| exchange | string | exchange code |

| market | string | trading market |

| sec_type | string | security type |

| currency | string | trading currency |

| expiry | string | expiry date str(OPT、WAR、IOPT、FUT),e.g. 20171117 |

| right | string | option right(OPT、WAR、IOPT), including: PUT/CALL |

| strike | float | strike price |

| multiplier | float | multiplier (OPT,WAR,IOPT,FUT) |

Example:

static void test_get_quote_contract(const std::shared_ptr<TradeClient>& trade_client) {

value res = trade_client->get_quote_contract(U("00700"), U("IOPT"), U("20250328"));

ucout << U("quote contract: ") << res << endl;

}

Response:

[

{

"currency":"HKD",

"exchange":"SEHK",

"expiry":"20250328",

"market":"HK",

"multiplier":5000,

"name":"SG#TENCTRC2503A.C",

"right":"CALL",

"secType":"IOPT",

"strike":"357.2",

"symbol":"67069"

},

{

"currency":"HKD",

"exchange":"SEHK",

"expiry":"20250328",

"market":"HK",

"multiplier":10000,

"name":"MS#TENCTRC2503B.C",

"right":"CALL",

"secType":"IOPT",

"strike":"356.2",

"symbol":"67170"

},

{

"currency":"HKD",

"exchange":"SEHK",

"expiry":"20250328",

"market":"HK",

"multiplier":5000,

"name":"MS#TENCTRC2503A.C",

"right":"CALL",

"secType":"IOPT",

"strike":"267.2",

"symbol":"52228"

}

]