Get Contract

What is a Contract

We refer to what is being traded in an order as a "contract". The specs of a specific contract are set by a exchange, and are used to identify a specific asset in global markets, across the exchanges. This information, and the information required to trade a certain contract, are embedded in the Contract object.

A typical contract object includes the following elements:

- Symbol: The ticker symbol of the stock/equity. The symbol of most U.S stocks only contains letters, HK stocks and Chinese A-Shares uses numbers as symbols of stocks. For example, the symbol of Tiger Brokers (NASDAQ) is TIGR

- Security type: Common Security types includes STK(Stocks), OPT(Options), FUT(Futures) and CASH(Forex). For example, the Security type of Tiger Brokers (NASDAQ) is TIGR

- Currency type: common currencies include USD (US dollar), HKD (Hong Kong dollar).

- Exchange: The code of the exchange in which the requested asset is traded. Contracts with Security typ of STK does not require this data field, as the orders will be routed automatically to a designated exchange, However, for futures, this field is necessary

Most stocks, CFDs, indexes or Forex can be identified by those four elements. However, some contracts like Futures and Options has more attributes in their corresponding contract objects

Stocks

ContractItem contract = new ContractItem();

contract.setSymbol("TIGR");

contract.setSecType("STK");

contract.setCurrency("USD"); //Optional,default is USD

contract.setMarket("US"); //Optional, US by default but can be set to US(United States) , HK(HongKong), CN(A-Shares), SG(Singapore), AU(Australia)

Options

Tiger Securities's API support 2 option contract format:

One is the four-factor approach, including symbol, expiry, strike, right.

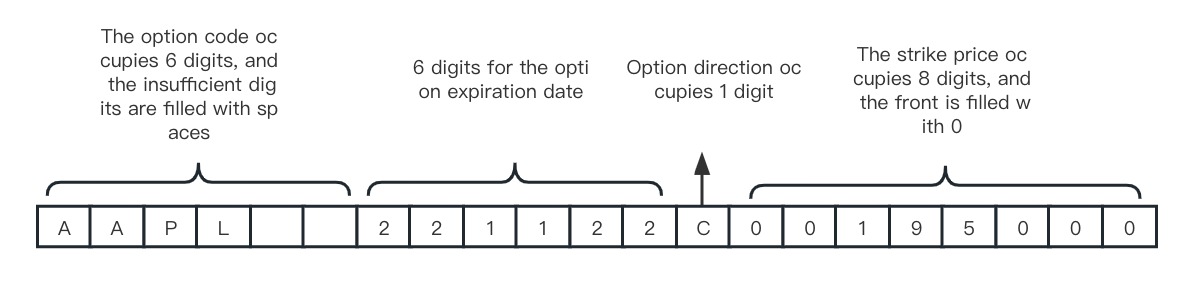

The other is the standard OCC option contract format, fixed length of 21 bits. contains four parts:

- The code of the relevant stock or ETP, e.g. (AAPL), is fixed at six characters, with the missing digits filled by spaces

- Option expiration date, 6 digits, format: yymmdd

- Option type,including P or C, for put or call

- Option exercise price, the value of the price x 1000, fixed 8 digits, the first few digits are filled by 0

ContractItem contract = new ContractItem();

contract.setSymbol("AAPL");

contract.setSecType("OPT");

contract.setCurrency("USD");

contract.setExpiry("20180821");

contract.setStrike(30D);

contract.setRight("CALL");

contract.setMultiplier(100.0D);

contract.setMarket("US"); // Optional

Futures

ContractItem contract = new ContractItem();

contract.setSymbol("CL1901");

contract.setSecType("FUT");

contract.setExchange("SGX");

contract.setCurrency("USD");

contract.setExpiry("20190328");

contract.setMultiplier(1.0D);

Funds

ContractItem contract = new ContractItem();

contract.setSymbol("IE00B11XZ988.USD");

contract.setSecType("FUND");

Get Contract

Description

Get contract information. Use this method with global account and prime account, ContractItem will have different data fields. Use the same account to get contract information and to place orders.

Argument

com.tigerbrokers.stock.openapi.client.https.request.contract.ContractRequest

| Argument | Type | optional | Description |

|---|---|---|---|

| account | string | Yes | Account id: 13810712 |

| symbol | string | Yes | Ticker symbol of the stock/equity, example: 'AAPL' |

| sec_type | string | Yes | Security type, example: STK |

| currency | string | No | USD/HKD/CNH |

| expiry | string | No | Options expiration date, format: 'yyyyMMdd', example: '20220121' |

| strike | double | No | Options strike price. Required for options |

| right | string | No | CALL/PUT. Required for options |

| exchange | string | No | Exchange code (U.S stocks SMART, Shanghai-Hong Kong Stock Connect-SEHK, A-Shares-SEHKNTL,Shenzhen-Hong Kong Stock Connect SEHKSZSE) |

| secret_key | string | No | secret key for the trader of institutions, please config in client_config, ignore if you are a indiviual user |

Response

com.tigerbrokers.stock.openapi.client.https.response.contract.ContractResponse

Use ContractResponse.getItem() to access returned data. This method will return a ContractItem object, wherecom.tigerbrokers.stock.openapi.client.https.domain.contract.item.ContractItemhas the following attributes:

| Name | Example | Description |

|---|---|---|

| identifier | CL2109/AAPL | Asset identifier |

| name | K12 INC | name of the asset |

| contractId | 1 | IB contract id |

| symbol | LRN | stock ticker symbol |

| secType | STK | STK/OPT/WAR/IOPT, STK by default |

| expiry | 20171117 | Contract expiration date |

| contractMonth | 201804 | Delivery month |

| strike | 24.0 | strike price for options |

| right | PUT | Put/Call for options |

| type | ES | futures type |

| multiplier | 0.0 | multiplier for options, futures, CBBCs |

| lotSize | 100 | lot size for stocks |

| exchange | NYSE | Exchange code |

| primaryExchange | NYSE | Primary exchange |

| market | US | market /US/HK/CN |

| currency | USD | USD/HKD/CNH |

| localSymbol | 1033 | used in HK market to identify warrant and CBBC |

| tradingClass | LRN | Trading class |

| minTick | 0.001 | minimum ticksize |

| tickSizes | [ { "begin":"0", "end":"1", "tickSize":0.0001, "type":"CLOSED" }, { "begin":"1", "end":"Infinity", "tickSize":0.01, "type":"OPEN" } ] | type: OPEN/OPEN_CLOSED/CLOSED/CLOSED_OPEN, tickSize:minTick for different price ranges |

| marginable | true | if able to purchase with financing |

| longInitialMargin | 1 | Long initial margin |

| longMaintenanceMargin | 1 | Long maintenance margin |

| shortInitialMargin | 0.35 | Short intial margin |

| shortMaintenanceMargin | 0.3 | Short maintenance margin(prime account only ) |

| shortable | true | available for shorting |

| shortableCount | 10000000 | amount of shares you can short |

| shortFeeRate | 0 | short fee rate |

| tradeable | true | if available for trading(STK type only) |

| closeOnly | false | Is it only possible to close the position |

| continuous | false | Futures only, if the contract is continuous |

| lastTradingDate | 2019-01-01 | Futures only, last trading date |

| firstNoticeDate | 2019-01-01 | Futures only, first notice date |

| lastBiddingCloseTime | 0 | Futures only, last bidding date |

| isEtf | boolean | is ETF |

| etfLeverage | integer | ETF leverage |

| discountedDayInitialMargin | 3069.0 | Exclusive to futures, intraday preferential initial margin ratio |

| discountedDayMaintenanceMargin | 2790.0 | Exclusive to futures, intraday preferential maintenance margin ratio |

| discountedTimeZoneCode | CDT | Exclusive to futures, intraday preferential time and time zone |

| discountedStartAt | 17:30:00 | Exclusive to futures, start time of discount within the day |

| discountedEndAt | 14:30:00 | Exclusive to futures, the end time of the discount within the day |

| supportOvernightTrading | true | support overnight trading (only for US market stocks) |

| supportFractionalShare | true | support fractional share trading |

Example

// init trade client

TigerHttpClient client = TigerHttpClient.getInstance().clientConfig(ClientConfig.DEFAULT_CONFIG);

// get stock contract

ContractRequest contractRequest = ContractRequest.newRequest(new ContractModel("AAPL"));

ContractResponse contractResponse = client.execute(contractRequest);

System.out.println("return stock contract:" + JSONObject.toJSONString(contractResponse));

// get options contract

ContractModel model = new ContractModel("AAPL", SecType.OPT.name(),Currency.USD.name(), "20211126", 150D, Right.CALL.name());

contractRequest = ContractRequest.newRequest(model);

contractResponse = client.execute(contractRequest);

System.out.println("return option contract:" + JSONObject.toJSONString(contractResponse));

// get warrant contract

ContractModel contractModel = new ContractModel("13745", SecType.WAR.name());

contractModel.setStrike(719.38D);

contractModel.setRight(Right.CALL.name());

contractModel.setExpiry("20211223");

ContractRequest contractRequest = ContractRequest.newRequest(contractModel);

ContractResponse contractResponse = client.execute(contractRequest);

System.out.println("return warrant contract:" + JSONObject.toJSONString(contractResponse));

// get future contract

ContractRequest contractRequest = ContractRequest.newRequest(

new ContractModel("JPY2306", SecType.FUT.name()), "572386");

ContractResponse contractResponse = client.execute(contractRequest);

System.out.println("return future contract:" + JSONObject.toJSONString(contractResponse));

Response Example

{

"code":0,

"data":{

"closeOnly":false,

"currency":"USD",

"etf":false,

"identifier":"AAPL",

"localSymbol":"AAPL",

"longInitialMargin":0.3,

"longMaintenanceMargin":0.25,

"marginable":true,

"market":"US",

"multiplier":1,

"name":"Apple",

"secType":"STK",

"shortInitialMargin":0.35,

"shortMaintenanceMargin":0.3,

"symbol":"AAPL",

"tickSizes":[

{

"begin":"0",

"end":"1",

"tickSize":0.0001,

"type":"CLOSED"

},

{

"begin":"1",

"end":"Infinity",

"tickSize":0.01,

"type":"OPEN"

}

],

"tradeable":true,

"tradingClass":"AAPL"

},

"message":"success",

"sign":"cWxRpcxoN7fICIBBK9WAq18TVtG7ez7dGJaCWOjSLHR8sQINPImZmAly9ctwCseA004K1f/7MgiHz4P9u48YdG9Vm07mUYdiNGaNJ4o79hPMi6Vq5IGMGOYFw3MQ/bZr6ikndgDZS7qQwDpBfeqTTDvzfxWFOh080wHw0SzE+co=",

"success":true,

"timestamp":1680838347544

}

Get Multiple Contracts

Description

Get multiple contracts. Use this method with global account and prime account, ContractItem will have different data fields. Use the same account to get contract information and to place orders.

CAUTION

There is no field related to margin in the contract returned by the prime account

Argument

com.tigerbrokers.stock.openapi.client.https.request.contract.ContractsRequest

| Argument | Type | optional | Description |

|---|---|---|---|

| account | string | Yes | Account id: 13810712 |

| symbols | List<string> | Yes | Ticker symbol of the stock/equity, example: 'AAPL'. Maximum 50 per request |

| sec_type | string | Yes | Security type, example: STK/FUT |

| currency | string | No | USD/HKD/CNH |

| secret_key | string | No | secret key for the trader of institutions, please config in client_config, ignore if you are a indiviual user |

Response

com.tigerbrokers.stock.openapi.client.https.response.contract.ContractsResponse

Use ContractsResponse.getItems() to access returned data. This method will return ContractItem objects, wherecom.tigerbrokers.stock.openapi.client.https.domain.contract.item.ContractItem has the following attributes:

| Name | Example | Description |

|---|---|---|

| identifier | CL2109/AAPL | Asset identifier |

| name | K12 INC | name of the asset |

| contractId | 1 | IB contract id |

| symbol | LRN | stock ticker symbol |

| secType | STK | STK/OPT/WAR/IOPT, STK by default |

| expiry | 20171117 | Contract expiration date |

| contractMonth | 201804 | Delivery month |

| strike | 24.0 | strike price for options |

| right | PUT | Put/Call for options |

| type | ES | futures type |

| multiplier | 0.0 | multiplier for options, futures, CBBCs |

| exchange | NYSE | Exchange code |

| primaryExchange | NYSE | Primary exchange |

| market | US | market /US/HK/CN |

| currency | USD | USD/HKD/CNH |

| localSymbol | 1033 | used in HK market to identify warrant and CBBC |

| tradingClass | LRN | Trading class |

| minTick | 0.001 | minimum ticksize |

| tickSizes | [ { "begin":"0", "end":"1", "tickSize":0.0001, "type":"CLOSED" }, { "begin":"1", "end":"Infinity", "tickSize":0.01, "type":"OPEN" } ] | only support stocks,type: OPEN/OPEN_CLOSED/CLOSED/CLOSED_OPEN, tickSize:minTick for different price ranges |

| marginable | true | if able to purchase with financing |

| longInitialMargin | 1 | Long initial margin |

| longMaintenanceMargin | 1 | Long maintenance margin |

| shortInitialMargin | 0.35 | Short initial margin |

| shortMaintenanceMargin | 0.3 | Short maintenance margin(prime account only ) |

| shortable | true | available for shorting |

| shortableCount | 10000000 | amount of shares you can short |

| shortFeeRate | 0 | short fee rate |

| tradeable | true | if available for trading(STK type only) |

| closeOnly | false | Is it only possible to close the position |

| continuous | false | Futures only, if the contract is continuous |

| lastTradingDate | 2019-01-01 | Futures only, last trading date |

| firstNoticeDate | 2019-01-01 | Futures only, first notice date |

| lastBiddingCloseTime | 0 | Futures only, last bidding date |

| isEtf | false | is ETF |

| etfLeverage | 0 | ETF leverage |

| supportOvernightTrading | true | support overnight trading (only for US market stocks) |

Example

List<String> symbols = new ArrayList<>();

symbols.add("AAPL");

symbols.add("TSLA");

ContractsModel models = new ContractsModel(symbols, SecType.STK.name());

ContractsRequest contractsRequest = ContractsRequest.newRequest(models, "13810712");

ContractsResponse contractsResponse = client.execute(contractsRequest);

System.out.println("return contracts:" + JSONObject.toJSONString(contractsResponse));

Response Example

{

"code":0,

"data":[

{

"currency":"USD",

"etf":false,

"identifier":"AAPL",

"localSymbol":"AAPL",

"market":"US",

"multiplier":1,

"name":"Apple Inc",

"secType":"STK",

"symbol":"AAPL",

"tickSizes":[

{

"begin":"0",

"end":"1",

"tickSize":0.0001,

"type":"CLOSED"

},

{

"begin":"1",

"end":"Infinity",

"tickSize":0.01,

"type":"OPEN"

}

],

"tradeable":true,

"tradingClass":"AAPL"

},

{

"currency":"USD",

"etf":false,

"identifier":"TSLA",

"localSymbol":"TSLA",

"market":"US",

"multiplier":1,

"name":"Tesla Motors",

"secType":"STK",

"symbol":"TSLA",

"tickSizes":[

{

"begin":"0",

"end":"1",

"tickSize":0.0001,

"type":"CLOSED"

},

{

"begin":"1",

"end":"Infinity",

"tickSize":0.01,

"type":"OPEN"

}

],

"tradeable":true,

"tradingClass":"TSLA"

}

],

"message":"success",

"sign":"Bv8H6BBfKOrMOhdJAanE0hwJiJAoKOk55/cTkJIVSmw9ENd2nmbeBI3cesqRgPq8bJ2dUBrYr+cqLVG65meXwbaFYyEenWlNyigl02IuJVoETgChuSoX1SZBTnafoVivCIj3neWG8BFdhaTNNXfBMbeSYf01+BqI6xYEc6KQxKc=",

"success":true,

"timestamp":1684912317872

}

Get Contract for Options and Warrants

Description

Get stock‘s Warrant and CBBC contracts

Argument

| Argument | Type | Required | Description |

|---|---|---|---|

| symbols | string | Yes | symbol of the underlying asset |

| sec_type | string | Yes | Security types, possible values are: OPT-options/ WAR-warrants/ IOPT-CBBCs) |

| expiry | String | No | Expiration date(yyyyMMdd), must have a value for OPT type |

| lang | string | No | Language: zh_CN,zh_TW,en_US, en_US by default |

Response:com.tigerbrokers.stock.openapi.client.https.response.quote.QuoteContractResponse

Use QuoteContractResponse.getContractItems() to access returned data. This method will return a list of QuoteContractItem object, wherecom.tigerbrokers.stock.openapi.client.https.domain.quote.item.QuoteContractItem has the following attributes:

| Name | Type | Description |

|---|---|---|

| symbol | string | Stock ticker symbol |

| name | string | Contract name |

| exchange | string | Exchange where the contract is traded |

| market | string | Market where the contract is traded |

| secType | string | Security type |

| currency | string | Currency |

| expiry | string | Expiration date for options, warrants, CBBC, futures, e.g. 20171117 |

| right | string | PUT/CALL for options, warrants, futures and CBBCs |

| strike | string | Strike price |

| multiplier | double | Multiplier for options, warrants, futures and CBBCs |

Response Example:

QuoteContractResponse response = client.execute(QuoteContractRequest.newRequest("00700", SecType.WAR, "20211223"));

if (response.isSuccess()) {

System.out.println(response.getContractItems());

} else {

System.out.println("response error:" + response.getMessage());

}

Response Example:

{

"code": 0,

"data": [{

"items": [{

"currency": "HKD",

"exchange": "SEHK",

"expiry": "20211223",

"market": "HK",

"multiplier": 50000.0,

"name": "MSTENCT@EC2112B.C",

"right": "CALL",

"secType": "WAR",

"strike": "719.38",

"symbol": "13745"

}, {

"currency": "HKD",

"exchange": "SEHK",

"expiry": "20211223",

"market": "HK",

"multiplier": 5000.0,

"name": "JPTENCT@EC2112A.C",

"right": "CALL",

"secType": "WAR",

"strike": "900.5",

"symbol": "13680"

}],

"secType": "WAR",

"symbol": "00700"

}],

"message": "success",

"sign": "bxQhZiWMsT9aSVTNtt2SXVeeh5w8Ypug/6UY3nL9N7LFKB1YxBVpQoKDJ4JloFojyb/CPCGT0fCXTxboDBTZvnA4stjbh1YqbNlz2lNqmHhpxYUKMdE+w2hFKVvoYMlMPCmsY5NqSQ3S/fsSzZrJyxBRPzZ+d+0qb7VSYw9yhho=",

"success": true,

"timestamp": 1637686550209

}